PMA’s Doug King Talks Preventative Care, Evolving Healthcare Trends and Challenges

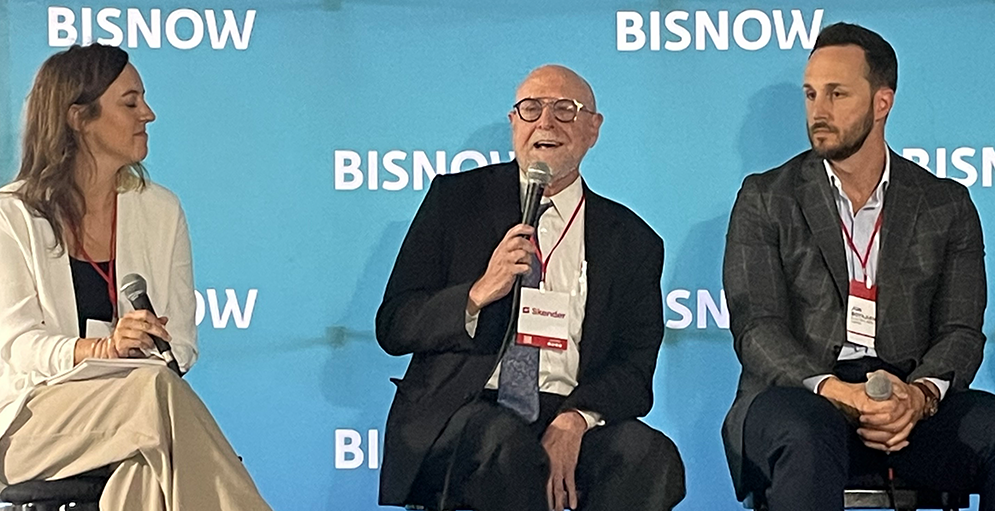

Doug King, Vice President and National Healthcare Sector Lead at Project Management Advisors, Inc. was part of a panel discussion, “Analyzing Today’s Healthcare Landscape,” at the Bisnow Chicago Healthcare Summit, which took place on September 25, 2023, at the Mag Mile Medical Pavilion. The event brought together healthcare systems, brokers, owners, developers, investors, contractors, end-users, and other industry thought leaders to discuss the latest in development, design and patient experience trends and how they’re impacting the healthcare real estate industry.

The panel discussion focused on Chicago’s inpatient and outpatient landscape. Moderated by Nichole Czapek, vice president of HKS, Mr. King was joined by panelists Justin Shea, principal of Hammes Partners; Rolla Sweis, vice president of operations for South Chicagoland at Advocate Health; Jesse Ostrow, CIO of RX Health & Science Trust; and Jon Boyajian, Principal of Echo Real Estate Capital.

King suggests that hospitals have evolved into a primary setting for patient recovery, with a strong emphasis on minimizing readmissions. Consequently, there has been a notable surge in the demand for acute care, inpatient rehabilitation facilities, and physical rehabilitation services nationwide. King notes that in the past, healthcare often followed the maxim of “follow the money,” but today, financial priorities are shifting towards a focus on preventative care.

Below are a few other snippets of the discussion from the panel, which have been edited and condensed for clarity.

Ms. Czapek: How will patient-centric facilities increase care through increased quality of care? And, can value-based systems that are small, independent healthcare facilities be adopted into national systems?

Mr. King: The government is attempting to change reimbursement to one that is value based, where they are trying to get ahead of the curve and treat illness and symptoms in advance. There is an extreme interest in programs that enable people to recover successfully.

Mr. Ostrow: From an investment perspective, it is all about the patient experience. When we buy the building, we go through our checklist and think about our investment through the eyes of our patients, analyze the building, the parking etc., because that is how our tenants think about them. It is also what helps attract them to, and keeps them in, our building.

Ms. Czapek: How has site selection changed?

Mr. Boyajian: You can categorize our investments in two buckets in terms of the physical medical office building. The first being a traditional multi-tenant multistory medical office with a common core lobby and a big parking field out front. In this scenario, patients would typically have to park out in the parking field and have to walk a long way into a lobby, then find whoever the physician is on the signage, go up the elevator, down the hall and take a right and so forth. The other bucket, and what we have found to be successful for us, is single-story multi-tenant medical office buildings where there are individual tenant entrances, individual signage above each of them and it almost functions like a multi-tenant retail building. In those properties, tenants park out front and walk right in the door automatically into the lobby. We have invested in both, and will continue to do so, but from a trend standpoint, what we really like is the convenience and the layout for both patients and providers in the single-story multi-tenant medical space.

Mr. Shea: From a development perspective, when we are doing site selection, it is also important to have a few key physicians in the room who have a say at the table. They can help us locate the right facility… It is about having a partnership with the healthcare system.

Ms. Czapek: With the shortage of future medical professionals, what can we do in the industry now to maintain accessible care in the future?

Ms. Sweis: We are focused on making sure our facilities are easy for our patients and our providers. We are trying to keep clinics close to the hospital, so that it can be a one-stop-shop for those additional services, whether it is lab imaging, tests etc. We are also pushing to make sure we have telemedicine capabilities present and functional.

Mr. King: We are currently working on a 2.9-million-square-foot hospital in Toronto where all the services in the entire hospital are being done through AI robotics, such as automated guided vehicles and autonomous mobile robots. We are doing this in part to address the labor shortage issues that are projected — part of which is due to birth rate, which is expected to be an issue with staffing.

Ms. Czapek: What are you seeing in terms of financing? Where are you spending money right now?

Mr. Boyajian: Financing is a challenge. Traditionally, we have used regional bank debt and have not gone the institutional route—mostly because our deal sizes don’t really dictate that we would use institutional capital, equity and debt. I recently called 39 banks on a project in Indiana to get three term sheets. Most of the responses were that, while it looked like a great project, they wanted to know how much money we could put in their bank, because they are all trying to shore up their deposits, credit and lending constraints, which are being increasingly scrutinized.

Ms. Czapek: What types of developments are you seeing in the future?

Mr. King: In Chicago, we are fortunate to have some of the best academic medical centers in the world and community health centers/networks. One of the things that struck me is the relationship between our health organizations and the quest of cities looking to boost their health and attract people who want to live in a healthy city. If you follow the ULI agenda for achieving healthy living environments, it is in line with the healthcare model in general … There’s cooperation, both between institutions and at a healthcare level, but also with the city and state government.

The Art of Winning Work in Behavioral Health Facility Development

Winning funding or work in behavioral health facility development is part science, part art.